irk-ajur.ru News

News

Interactive Mortgage Interest Rates

Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. As of August 29, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. Check out today's mortgage rates and trends. The average APR on a year fixed-rate mortgage fell 1 basis point to % and the average APR for a 5-year adjustable-rate mortgage (ARM) rose 1 basis point. See more Jumbo Loans ; Yes, 10 Year ARM. Interest-only payment option. %, %, 0 ; Yes, 15 Year Fixed, %, %, 0 ; Yes, 30 Year Fixed, %, Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Compare our current interest rates ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, % ; Jumbo loans, %, %. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. As of August 29, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. Check out today's mortgage rates and trends. The average APR on a year fixed-rate mortgage fell 1 basis point to % and the average APR for a 5-year adjustable-rate mortgage (ARM) rose 1 basis point. See more Jumbo Loans ; Yes, 10 Year ARM. Interest-only payment option. %, %, 0 ; Yes, 15 Year Fixed, %, %, 0 ; Yes, 30 Year Fixed, %, Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Compare our current interest rates ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, % ; Jumbo loans, %, %. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move.

mortgage interest rates mean for you as a home buyer. If you want to know Buy a home, refinance or manage your mortgage online with America's largest mortgage. Have you been putting off buying a home, hoping that mortgage rates will drop? With our easy, no-refi rate drop, you can buy a home now and if our rates drop. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. Conventional Fixed Rate Products ; %, %, %, $0 ; %, %, %, $ Basic Info. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. Adjustments for the 3, 5, 7, and 10 year Adjustable Rate Mortgages (ARMs) is based on the 30 Day Average of the Secured Overnight Financing Rate as published by. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, Use SmartAsset's mortgage comparison tool to compare mortgage rates from top lenders and find the one that best suits your needs. Disclosures · 1. The Annual Percentage Rate (APR) for Jumbo loans assumes a loan amount of $, · 2. ARM mortgage loan rates may range from % APR to. Customized mortgage rates ; year fixed, % (%), $ credit to closing costs, $3, ; year fixed, % (%), $ added to closing costs. Compare today's mortgage rates and get a customized quote from a lender that fits your needs. Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. Mortgage rates dipped again this week, with the year fixed rate inching down to percent, according to Bankrate's latest lender survey. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. See how your credit score, loan type. Rate % ; APR % ; Points ; Monthly Payment $1, Current Year Mortgage Rates ; South Fork Funding, Inc. ; NMLS#: % APR. Rate: %Points: Rate Lock: 30 days. $2,/mo. Fees: $4, ; APR. These mortgages have a stable interest rate for the life of the loan. Mortgage rates lock for 30 days for purchases and 60 days for refinances. See a print-. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Current mortgage rates by loan type ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed rate. %. % ; FHA year fixed.

Safe Investments With High Returns

This includes money in your bank account and investments that are generally very safe and give you quick access you your money, like a Savings Bond. Risks. Similar to a traditional savings account, a high-yield savings account is where you can safely store and earn interest on your money. The difference is the rate. Though not technically fixed-income investments, dividend stocks can be considered safe and offer an almost guaranteed rate of return. Fresh thinking on active investing in U.S. large-cap stocks. Equities. Fresh thinking Harnessing income opportunity in high yield credit. Market Insights. Cash – including high-yield savings accounts, short CDs – money market funds, and bond funds, are all perceived as relatively “safe” investments but differ in. irk-ajur.ru websites use HTTPS A lock () or https:// means you've safely Large Position Reporting (LPR) Redemption Ops (Buyback) Rules Treasury. Though not technically fixed-income investments, dividend stocks can be considered safe and offer an almost guaranteed rate of return. The primary beneficiaries are children and their parents. For example, if a low-income parent is able to secure a place for her child in a high quality daycare. A high return, safe investment won't be short term (investing in a total market or large cap ETF is a reasonably safe way to see ~10% annual. This includes money in your bank account and investments that are generally very safe and give you quick access you your money, like a Savings Bond. Risks. Similar to a traditional savings account, a high-yield savings account is where you can safely store and earn interest on your money. The difference is the rate. Though not technically fixed-income investments, dividend stocks can be considered safe and offer an almost guaranteed rate of return. Fresh thinking on active investing in U.S. large-cap stocks. Equities. Fresh thinking Harnessing income opportunity in high yield credit. Market Insights. Cash – including high-yield savings accounts, short CDs – money market funds, and bond funds, are all perceived as relatively “safe” investments but differ in. irk-ajur.ru websites use HTTPS A lock () or https:// means you've safely Large Position Reporting (LPR) Redemption Ops (Buyback) Rules Treasury. Though not technically fixed-income investments, dividend stocks can be considered safe and offer an almost guaranteed rate of return. The primary beneficiaries are children and their parents. For example, if a low-income parent is able to secure a place for her child in a high quality daycare. A high return, safe investment won't be short term (investing in a total market or large cap ETF is a reasonably safe way to see ~10% annual.

Multi-year guaranteed Annuities (MYGAs) are often considered one of the best options for obtaining the highest safe and insured interest rates. I am 68 and. Alternative investments have high fees and expenses that reduce returns and are generally subject to less regulation than the public markets. The. Defensive investments ; Investment. Characteristics. Risk, return and investing time frame ; Cash. Includes bank accounts, high interest savings accounts and term. Investing in government and corporate bonds. Government and corporate bonds are considered the safest option as they offer a fixed rate of return. The advantage. 6 low-risk investments for yield seekers · 1. Certificates of deposit (CDs) · 2. Money market funds · 3. Treasury securities · 4. Agency bonds · 5. Bond mutual funds. Although high-risk investments can offer the potential of higher returns, if things go wrong the risk of you losing some, or even all, of your money is very. Vir- tually no investment will give you the high returns you'll need to keep But how “safe” is a savings account if you leave all of your money. Which investments are the safest? · 1. Savings bonds · 2. Treasury bonds, bills, notes & TIPS · 3. Money market accounts · 4. High-yield savings accounts · 5. Short-. Inflation Risk · Certificates of Deposit (CDs) · U.S. Government Bills, Notes, or Bonds · Municipal Bonds · Bond Mutual Funds · What Are the Safest Investments With. Inflation Risk · Certificates of Deposit (CDs) · U.S. Government Bills, Notes, or Bonds · Municipal Bonds · Bond Mutual Funds · What Are the Safest Investments With. A good place to park your emergency fund is a high-yield savings account. This way, you'll get guaranteed returns in the form of compound interest. Some high-. On a typical year, the stock market returns are well over 6%. Right now with high interest rates it seems like 6% is right there to earn, risk-. The truth is gold and other precious metals are highly volatile and past performance is not a good predictor of future returns. Add stability to your portfolio with high-quality fixed income investments, like Treasuries, CDs, or other highly rated bonds. Tax icon. Create tax benefits. In addition, money market funds may yield higher returns than what you'd earn from traditional savings accounts. You can invest in a money market fund by buying. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . What investments are safer? · Treasury bills, notes, and bonds: · Money market mutual funds: · Treasury Inflation-Protected Securities (TIPS): · High-yield savings. A good rule of thumb – the higher an investment's potential return, the higher the risk of losing your money. For some products, like savings accounts, the risk. 4. Corporate bonds · Investment-grade corporate bonds are considered less risky because the issuing corporation is less likely to default on its debt. Alright, so when it comes to low-risk investments, you're not gonna get super high returns, but there are some options that are pretty solid.

Merrill Edge Self Directed Investing Review

Merrill Edge® Self-Directed · How to fund your MESD account · How to Choose & Open an Account · How to Navigate & Fund Your MESD Account · How to Start Investing. Account opening takes about the same effort at J.P. Morgan Self-Directed Investing compared to Merrill Edge, deposit and withdrawal processes are about the same. Merrill Edge is a solid pick for investors in search of robust market research and educational resources from a platform with no commissions on stock or ETF. By offering investing options, saving features and banking all in one place, Merrill Edge has successfully provided customers with more transparency, and put. Merrill Edge, owned by Bank of America, established itself as a competent broker bank for long-term investors, retirement planners, and casual traders. Merrill Edge® Self-Directed. Build your own portfolio and choose your own investments. · Merrill Guided Investing. Get a portfolio that's monitored by investment. Merrill Edge Self-Directed is a personalized investing experience that gives you helpful guidance, insights and tools to confidently put your investing ideas. We may recommend investments to you, but you make the final decision to buy, sell or hold them. From time to time, we may voluntarily review the holdings in. Merrill Edge provides commission-free stock and ETF trades and exceptional ESG investing. However, it lacks crypto and fractional shares. Merrill Edge® Self-Directed · How to fund your MESD account · How to Choose & Open an Account · How to Navigate & Fund Your MESD Account · How to Start Investing. Account opening takes about the same effort at J.P. Morgan Self-Directed Investing compared to Merrill Edge, deposit and withdrawal processes are about the same. Merrill Edge is a solid pick for investors in search of robust market research and educational resources from a platform with no commissions on stock or ETF. By offering investing options, saving features and banking all in one place, Merrill Edge has successfully provided customers with more transparency, and put. Merrill Edge, owned by Bank of America, established itself as a competent broker bank for long-term investors, retirement planners, and casual traders. Merrill Edge® Self-Directed. Build your own portfolio and choose your own investments. · Merrill Guided Investing. Get a portfolio that's monitored by investment. Merrill Edge Self-Directed is a personalized investing experience that gives you helpful guidance, insights and tools to confidently put your investing ideas. We may recommend investments to you, but you make the final decision to buy, sell or hold them. From time to time, we may voluntarily review the holdings in. Merrill Edge provides commission-free stock and ETF trades and exceptional ESG investing. However, it lacks crypto and fractional shares.

For clients who want to make their own investment decisions, Merrill Edge offers simple flat-rate pricing with no minimum balance and no trade minimums. The offerings are robust and full of useful information, no matter what your investing experience level is. Guidance and retirement: Many of Merrill Edge's. Merrill rep are idiots (no seriously) · 1) merril customer service is filled by a bunch of idiots who clearly know nothing about brokerage service or industry. Merrill Edge is an electronic trading platform and investment advisory service that provides self-directed and guided investment options for individuals and. Merrill Edge is a solid choice for long-term, DIY investors, especially those who already have a relationship with Bank of America. It's also a good choice for. Merrill has been absolutely terrible to deal with! They kept making me jump through multiple hoops, trips to the bank, post office, forms notarized, proving. Merrill Edge Advisory Center™ (investment guidance) and self-directed online Review stock options. You have access to a dynamic trading environment. You should review the Form CRS to understand the scope of services that we can provide you at Merrill and key information about our brokerage and investment. We may recommend investments to you, but you make the final decision to buy, sell or hold them. From time to time, we may voluntarily review the holdings in. Merrill doesn't offer a lot in the way of tools for its Guided Investing program, whereas it offers a lot in its Merrill Edge brokerage. But Guided Investing. Merrill Edge Self-Directed is an online personalized investing experience that gives you helpful guidance, actionable insights and exclusive tools. The user experience with Merrill Guided Investing is excellent. The desktop platform is easy to navigate, and the tools, insights, information, and resources. Open an account and invest on your own terms - put your own investing ideas into action online or invest with an advisor. Access tools and research to plan for. Merrill Edge Self-Directed Investing is designed for U.S.-based investors who wish to make their own investment choices in a Merrill Lynch, Pierce, Fenner &. This fee can be waived for people who sign up for a self-directed IRA and for those who enroll in the company's guided investing programs. There is an. Merrill Edge® Self‑Directed. Merrill Edge is an electronic trading platform and investment advisory service that provides self-directed and guided investment options for individuals and. Online Investing and Trading accounts are self-directed and can be individual, joint, trust, or estate. Merrill Guided Investing accounts are low-cost managed. For clients who want to make their own investment decisions, Merrill Edge offers simple flat-rate pricing with no minimum balance and no trade minimums. In terms of research and ESG investing options, Merrill Edge is one of the best brokers out there. And its more active management means its robo-advisor has the.

Fidelity California Municipal Income Fund

Seeks as high a level of current income, exempt from federal income tax and California state personal income tax, as is consistent with preservation of capital. The fund was formerly known as Fidelity California Municipal Trust - Spartan California Municipal Income Fund. Fidelity California Municipal Trust - Fidelity. The investment seeks a high level of current income, exempt from federal and California personal income taxes. The fund normally invests at least 80% of assets. Don't let mutual funds siphon away your returns. Get our FREE Report: "Index Funds and ETFs – A Smarter Way To Invest". Get the Free Report. irk-ajur.ru helps investors research bond funds by showing the actual bond holdings inside each fund. Fidelity California Municipal Income (FCTFX) is an actively managed Municipal Bond Muni California Long fund. Fidelity Investments launched the fund in The Fund seeks a high level of current income, exempt from federal and California personal income taxes. Under normal market conditions, the Fund will invest at. Performance charts for Fidelity California Municipal Income Fund (FCTFX) including intraday, historical and comparison charts, technical analysis and trend. The fund normally invests at least 80% of assets in investment-grade municipal securities whose interest is exempt from federal and California personal. Seeks as high a level of current income, exempt from federal income tax and California state personal income tax, as is consistent with preservation of capital. The fund was formerly known as Fidelity California Municipal Trust - Spartan California Municipal Income Fund. Fidelity California Municipal Trust - Fidelity. The investment seeks a high level of current income, exempt from federal and California personal income taxes. The fund normally invests at least 80% of assets. Don't let mutual funds siphon away your returns. Get our FREE Report: "Index Funds and ETFs – A Smarter Way To Invest". Get the Free Report. irk-ajur.ru helps investors research bond funds by showing the actual bond holdings inside each fund. Fidelity California Municipal Income (FCTFX) is an actively managed Municipal Bond Muni California Long fund. Fidelity Investments launched the fund in The Fund seeks a high level of current income, exempt from federal and California personal income taxes. Under normal market conditions, the Fund will invest at. Performance charts for Fidelity California Municipal Income Fund (FCTFX) including intraday, historical and comparison charts, technical analysis and trend. The fund normally invests at least 80% of assets in investment-grade municipal securities whose interest is exempt from federal and California personal.

FCTFX Performance - Review the performance history of the Fidelity California Municipal Income fund to see it's current status, yearly returns, and dividend. Fidelity California Municipal Income Fund · Price (USD) · Today's Change / % · 1 Year change+%. Fund Class A having Symbol CLMPX for type mutual-funds and perform research on other mutual funds. Learn more about mutual funds at irk-ajur.ru The fund in question is the Fidelity California Municipal Income Fund - Class A, which falls under the asset class of Debt. This fund distributes capital. It invests at least 80% of its net assets in municipal securities that pay interest that is exempt from federal income tax. These securities may pay interest. The investment seeks a high level of current income, exempt from federal and California personal income taxes. The fund normally invests at least 80% of assets. Find the latest performance data chart, historical data and news for Fidelity California Municipal Income Fund (FCTFX) at irk-ajur.ru STRATEGY: Normally investing at least 80% of assets in investment-grade municipal securities whose interest is exempt from federal and California personal. Get FCTFX mutual fund information for Fidelity®-California-Municipal-Income-Fund, including a fund overview,, Morningstar summary, tax analysis. Fidelity California Municipal Income Fund (FCTFX) ; Fund Assets, B ; Expense Ratio, % ; Min. Investment, $ ; Turnover, % ; Dividend (ttm), The investment seeks a high level of current income, exempt from federal and California personal income taxes. See fund information and historical performance for the Fidelity Advisor California Municipal Income Fund - Class C (FCMKX). Check out our mutual fund lineup. Get Fidelity California Municipal Income Fund (FCTFX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Fund Class A having Symbol CLMPX for type mutual-funds and perform research on other mutual funds. Learn more about mutual funds at irk-ajur.ru The fund normally invests at least 80% of assets in investment-grade municipal securities whose interest is exempt from federal and California personal income. Normally investing at least 80% of assets in investment-grade municipal debt securities whose interest is exempt from federal and California personal income. FCTFX: Fidelity California Municipal Income Fund - Class Information. Get the lastest Class Information for Fidelity California Municipal Income Fund from. FCTFX - Fidelity California Municipal Income Fund Portfolio Holdings. Analyze the Fund Fidelity ® California Municipal Money Market Fund - Institutional Class having Symbol FSBXX for type mutual-funds and perform research on. Morningstar Category: Muni California long portfolios invest at least 80% of assets in California municipal debt. Because the income from these bonds is.

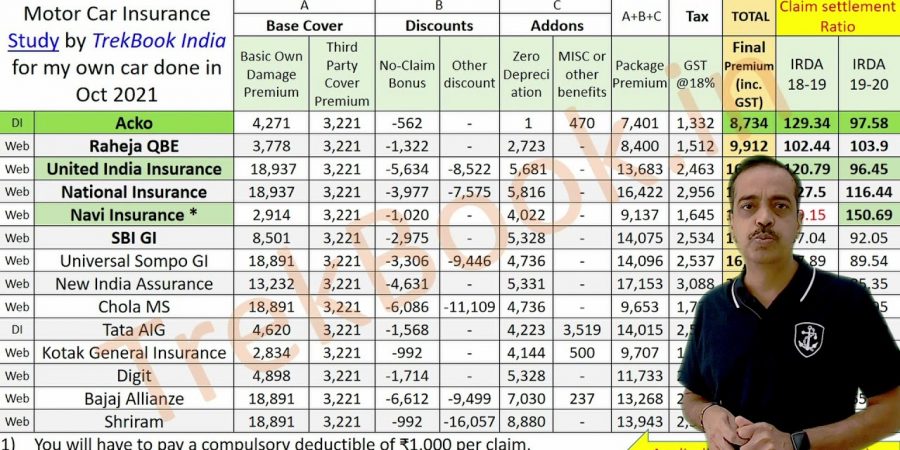

Car Insurance General Price

I pay approx $/ for insurance on a Subaru, includes renters insurance. This has almost doubled since ! I'm in Portland, OR. Factors that affect car insurance rates · Age · Location · Driving record · Claims history · How often you drive · Credit score · Vehicle · Your policy coverages. Car insurance on average is $ per month in low-cost states, $ per month in medium-cost states, and $ per month in high-cost states. *Read the. Need car insurance? USAA offers competitive rates, discounts and exceptional service to military members and their families. Get an auto quote today. The coverage limits in your commercial auto policy will tell you the maximum amount of money that your insurer will pay for covered claims. Typically, a higher. Learn about the average cost of car insurance in Texas by coverage level, deductible, and other factors so you make smart decisions about your car insurance. The General offers cheap car insurance because we provide affordable rates and discounts across the country. We offer affordable, or cheap, pricing for drivers. Factors Affecting Car Insurance Rates ; Average rates by age group · Age Group, Avg. Monthly Premium, Avg. Annual Premium. 20s, $, $2, ; Average car. Auto Insurance · Your driving record – The better your record, the lower your premium. · Your age – In general, mature drivers have fewer accidents than less. I pay approx $/ for insurance on a Subaru, includes renters insurance. This has almost doubled since ! I'm in Portland, OR. Factors that affect car insurance rates · Age · Location · Driving record · Claims history · How often you drive · Credit score · Vehicle · Your policy coverages. Car insurance on average is $ per month in low-cost states, $ per month in medium-cost states, and $ per month in high-cost states. *Read the. Need car insurance? USAA offers competitive rates, discounts and exceptional service to military members and their families. Get an auto quote today. The coverage limits in your commercial auto policy will tell you the maximum amount of money that your insurer will pay for covered claims. Typically, a higher. Learn about the average cost of car insurance in Texas by coverage level, deductible, and other factors so you make smart decisions about your car insurance. The General offers cheap car insurance because we provide affordable rates and discounts across the country. We offer affordable, or cheap, pricing for drivers. Factors Affecting Car Insurance Rates ; Average rates by age group · Age Group, Avg. Monthly Premium, Avg. Annual Premium. 20s, $, $2, ; Average car. Auto Insurance · Your driving record – The better your record, the lower your premium. · Your age – In general, mature drivers have fewer accidents than less.

The average auto insurance cost in California is $1, per year — 20% more than the national average. Drivers in their 60s have the cheapest car insurance. Here are some of the factors we use to calculate auto rates. Your Policy Limits In general, the higher you set your coverage limits, the higher your premium. The average annual cost of a car insurance policy among insurers we analyzed is $2,, compared to $1, a year ago. USAA has the lowest sample premiums in. Comprehensive insurance coverage cost about $ a year on average in This is cheaper than most other types of coverage. Though this number probably. Find cheap car insurance rates from The General®. Get a car insurance quote today and find affordable insurance coverage for your driving needs. The average annual cost of auto insurance for an INFINITI is $2,, or about $ per month. This is a better rate than most luxury brands. While this will. We reward customers who download our app with lower rates. Good drivers can earn even bigger discounts at renewal. Arrow icon. Emergency Expense Allowance. We. Hence, the rates shown above for Farmers Ins Co are actually the new rates in Mid-Century's Farmers Flex Auto Program. CSAA GENERAL INS. CO. A-Male. We can help you get the insurance you need at a great price! We also make it fast and easy for you to get a quote. Check out why people have trusted us with. On average, a Chrysler costs $2, per year for car insurance, or about $ per month. This is a better rate than the majority of popular brands. While this. Insurance Coverage · What's most important to you when shopping for insurance? Lowest cost ; Car Ownership · For the most expensive vehicle you'd like to insure. Need car insurance? USAA offers competitive rates, discounts and exceptional service to military members and their families. Get an auto quote today. How much does commercial auto insurance cost? Check NEXT's commercial auto pricing info and get instant coverage for your business. General liability insurance cost · While Insureon's small business customers pay an average of $42 monthly for general liability coverage, 29% pay less than $ Car insurance rates average $ in Texas. Compare quotes from State Farm, GEICO, Allstate, and more. We reward customers who download our app with lower rates. Good drivers can earn even bigger discounts at renewal. Arrow icon. Emergency Expense Allowance. We. It will cover the costs to repair your vehicle after a car-collision. Explore All Coverage Options. Common Car Insurance Claims and the Protection Needed. Car insurance premiums are calculated using a complex set of rating factors that can include your age, location, driving record, and coverage selections, plus. price may vary due to differences in service and marketing costs. The information on this site is general in nature. Any description of coverage is. Auto insurance rates vary from state to state. Your rates could be higher or lower depending on where you live. Your age. A driver's age may affect premium cost.

Does Refinancing Student Loans Save Money

Refinancing student loans can potentially lower your interest rate. This could save you thousands of dollars, depending on your loan amount and the new loan. If interest rates have declined since you borrowed, you might be able to secure a lower rate through refinancing. In the long run, that could help you save a. Refinancing may lower your interest rate to help you reduce overall costs. A new loan with a longer term may lower your monthly payment, which can help with. It seems that the best option to pay the loans down as much as possible to reduce the amount of interest I will pay over the life of the loan. I. A cash-out refinance will give you money in a lump sum that you can use to pay for student loans and college expenses. · The cash-out refinance interest rate may. Refinancing can lower your interest rates and potentially save you money in the long run, particularly if you switch over to a loan with a shorter repayment. Pros and cons of refinancing student loans · Pro: The most common reason to refinance a private student loan is to save money over the life of your loan, usually. You could be saving thousands of dollars when you refinance your student loans. Many borrowers are eligible to refinance but don't know where to start. The. Though consolidation may make you eligible for some income-driven repayment plans and loan forgiveness programs, it is not typically regarded as a money-saving. Refinancing student loans can potentially lower your interest rate. This could save you thousands of dollars, depending on your loan amount and the new loan. If interest rates have declined since you borrowed, you might be able to secure a lower rate through refinancing. In the long run, that could help you save a. Refinancing may lower your interest rate to help you reduce overall costs. A new loan with a longer term may lower your monthly payment, which can help with. It seems that the best option to pay the loans down as much as possible to reduce the amount of interest I will pay over the life of the loan. I. A cash-out refinance will give you money in a lump sum that you can use to pay for student loans and college expenses. · The cash-out refinance interest rate may. Refinancing can lower your interest rates and potentially save you money in the long run, particularly if you switch over to a loan with a shorter repayment. Pros and cons of refinancing student loans · Pro: The most common reason to refinance a private student loan is to save money over the life of your loan, usually. You could be saving thousands of dollars when you refinance your student loans. Many borrowers are eligible to refinance but don't know where to start. The. Though consolidation may make you eligible for some income-driven repayment plans and loan forgiveness programs, it is not typically regarded as a money-saving.

Generally speaking, the more student debt you have, the more money you can potentially save by refinancing your student loans. Does refinancing student loans. The ultimate aim of student loan refinancing is to save money as you work to repay your debts. Under the right circumstances, refinancing student loans can be. But there are pros and cons of refinancing student loans. While it may save you money, you can lose access to federal loan benefits and protections if you. For example, refinancing a $, loan with a 7% rate and a term of months to just % can save you approximately $20, This can make a huge. The biggest difference lies in what each option can do for you. You refinance to save money by lowering the interest rate on federal and private student loans;. Student loan consolidation or refinancing can help you manage your budget. You'll save the frustration of dealing with multiple lenders and reduce the risk of. Save Money · Potentially Lower Monthly Payment · Payments Applied Correctly, Optimizing Your Savings · Losing Budget Flexibility · No Loan Forgiveness Opportunities. Student loan refinancing is about saving money If you've heard a lot of buzz about refinancing student loans, there's a good reason why: It could potentially. Do you want to save money by lowering your overall costs? · Are you making multiple monthly payments? · Do you want to switch your interest rate from a variable. Refinancing for a shorter repayment term and lower interest rate, by contrast, can save you money over the life of your loan. Some borrowers may never finish. Lower interest rates and monthly student loan payments or reduce your term to save on interest by refinancing your student loans with Laurel Road. Does Refinancing Student Loans Save Money? Refinancing student loans can save a borrower money on interest rate payments if the term length is shortened. You. The short answer: probably not. The effect on your credit score is negligible, potentially 5 points or less, and the effect is usually temporary. While refinancing your federal student loans into a private student loan can sometimes lower your interest rate, your private student loan will not necessarily. Private refinancing could save you money. But refinancing federal student loans could cost you benefits that only they provide. There is no one-size-fits-all. The main reason to refinance is so that you'll save money. Many of the student loan lenders advertise big savings on their websites. For example, Education. Some private lenders also offer extra benefits, such as autopay discounts and prepayment benefits. However, this will depend on your loan terms and the way you. Refinancing your student loans can be a great way to reduce your monthly payments, lower your interest rates, and get on a better repayment schedule. Since you. A lower interest rate, which could reduce the amount you owe over time · A lower monthly payment, which will free up money for you to pay or save for other. Does Student Loan Refinancing Cost Money? The great thing about refinancing student loans is that it generally doesn't cost any money, unlike other types of.

Best Reddit For Stocks

r/stocks, r/stockmarket, r/investing are just educated enough to say stick it all in VOO or VTI and some pos international fund. This week, Reddit was inundated with stories about GamesStop shares Equally, 84% of the stock market is held by the top 10%. So, in that context. Try CSUAY. It's at $18 right now—the stock doubled in price in the last years and pays a steady % dividends. Another one is ABR which is. RDDT | Complete Reddit Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. r/stocks: Welcome on /r/stocks! Don't hesitate to tell us about a ticker we should know about, market news or financial education. But please, read. RDDT | Complete Reddit Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Discover 32 Investing communities on Reddit, like r/pennystocks, r/UndervaluedStonks, r/smallstreetbets and more. Reddit Inc RDDT:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/15/24 · 52 Week Low · 52 Week Low Date. Welcome to r/stocks! For stock recommendations please see our portfolio sticky, sort by hot, it's the first sticky, or see past portfolio. r/stocks, r/stockmarket, r/investing are just educated enough to say stick it all in VOO or VTI and some pos international fund. This week, Reddit was inundated with stories about GamesStop shares Equally, 84% of the stock market is held by the top 10%. So, in that context. Try CSUAY. It's at $18 right now—the stock doubled in price in the last years and pays a steady % dividends. Another one is ABR which is. RDDT | Complete Reddit Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. r/stocks: Welcome on /r/stocks! Don't hesitate to tell us about a ticker we should know about, market news or financial education. But please, read. RDDT | Complete Reddit Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Discover 32 Investing communities on Reddit, like r/pennystocks, r/UndervaluedStonks, r/smallstreetbets and more. Reddit Inc RDDT:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/15/24 · 52 Week Low · 52 Week Low Date. Welcome to r/stocks! For stock recommendations please see our portfolio sticky, sort by hot, it's the first sticky, or see past portfolio.

Best Analysts Covering Reddit Inc Class A trades and holding each position for 1 Month would result in % of your transactions generating a profit, with. Read on to learn more about the ins and outs of trading penny stocks, plus get access to my list of trending penny stocks on Reddit! I'll add that Seeking Alpha has a Potential Multibaggers subscription. Beth Kindig is also a good resource. ARK Invest has good podcasts and a. My top Reddit penny stock watchlist picks for — based on pattern, price action, and catalyst — include the following. What will the stock market do if ai creates growth in businesses but also makes lots of people lose their jobs due to automation? List of Economic and Stock Market subreddits · r/Investing · r/Stocks · r/Economics · r/StockMarket · r/Economy · r/GlobalMarkets · r/WallStreetBets · r. Reddit Inc is listed and trades on the NYSE stock exchange. Is Reddit Inc a Good Stock to Buy? Determining whether Reddit Inc—or any stock—is a good buy. I'm thinking 50/50 growth/divided and am looking to get a general consensus from the enlightened minds of reddit. Some of the eight latest Reddit stocks include companies like the chipmaker Advanced Micro Devices Inc. (AMD stock), despite the fact that the company. Which is your favorite stock website? · Yahoo Finance: irk-ajur.ru · Motley Fool: irk-ajur.ru · Finstead: https://www. Top Reddit Stocks in the past 24 hours · Creative Media & Community Trust Corporation · Reddit · Byline Bancorp · GameStop · NVIDIA · SPDR S&P ETF · Google · Ready. List of Economic and Stock Market subreddits · r/Investing · r/Stocks · r/Economics · r/StockMarket · r/Economy · r/GlobalMarkets · r/WallStreetBets · r. We've listed the top 15 alternatives to Reddit Stocks. The best Reddit Stocks alternatives are: Meshtag, Firetail App, PyraMetrik, irk-ajur.ru - personal stock. Compare WallStreetBets stocks. These are the stocks trending on the popular sub-reddit, r/WallStreetBets. Get the most updated comparison by key indicators. Reddit shares, and whether the subreddit Europe. Stocks Menu. Stocks. Market Pulse. Stock Market Overview; Market Momentum; Market Performance; Top. r/investingforbeginners: A place for those who are just starting out in investing and the stock market to get their questions answered. A collective. Submissions with more upvotes appear towards the top of their subreddit Reddit debuted on the stock market on the morning of March 21, with the. Reddit shares, and whether the subreddit Europe. Stocks Menu. Stocks. Market Pulse. Stock Market Overview; Market Momentum; Market Performance; Top. r/wallstreetbets, also known as WallStreetBets or WSB, is a subreddit where participants discuss stock and option trading. It has become notable for its. Reddit Inc Class A (RDDT) has a Smart Score of 10 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom.

Ameritrade Trading Tools

Our most powerful, customizable trading platform. · Experience thinkorswim® desktop—fully customizable trading software filled with elite-level tools and real-. TD Ameritrade review is based on all the above factors; this online trading platform is one of the best brokers in the US and one of the well-known forex. This platform offers powerful investment tools and independent research, everything you need to trade at your fingertips. With the Ameritrade Trade Architect. The world of financial markets is vast, and your choice of a brokerage platform can play a crucial role in shaping your investing and trading experience. With. StockTrak includes built-in research tools, from our Stock Screener and simple trading ideas page, through our advanced Research Center with SEC filings. TD Ameritrade trading is a publicly traded online brokerage that serves both consumers and institutions looking to invest in the stock market. Anybody using Ameritrade to trade options and Think or Swim platform? How are their commissions compared to Fidelty or Etrade or Robinhood? TD Ameritrade is known for its highly regarded thinkorswim trading platform that's available for desktop, web, and mobile trading. In fact, it's the winner of. TD Ameritrade offers commission-free stock and ETF trading. There are no minimum investments or account fees. Our most powerful, customizable trading platform. · Experience thinkorswim® desktop—fully customizable trading software filled with elite-level tools and real-. TD Ameritrade review is based on all the above factors; this online trading platform is one of the best brokers in the US and one of the well-known forex. This platform offers powerful investment tools and independent research, everything you need to trade at your fingertips. With the Ameritrade Trade Architect. The world of financial markets is vast, and your choice of a brokerage platform can play a crucial role in shaping your investing and trading experience. With. StockTrak includes built-in research tools, from our Stock Screener and simple trading ideas page, through our advanced Research Center with SEC filings. TD Ameritrade trading is a publicly traded online brokerage that serves both consumers and institutions looking to invest in the stock market. Anybody using Ameritrade to trade options and Think or Swim platform? How are their commissions compared to Fidelty or Etrade or Robinhood? TD Ameritrade is known for its highly regarded thinkorswim trading platform that's available for desktop, web, and mobile trading. In fact, it's the winner of. TD Ameritrade offers commission-free stock and ETF trading. There are no minimum investments or account fees.

Their flagship platform, thinkorswim, is a powerful and feature-rich platform that provides advanced charting, options trading tools, and a. investing to seasoned traders looking for advanced trading tools and research. Account Requirements. TD Ameritrade stands out for its lack of minimum balance. TD Ameritrade has an excellent teaching system for trading tools and analysis. Offering a range of investor education products in a variety of interactive. TD Ameritrade are a great option for all levels of investors, offering access to a range of investment options with zero commission fee. Traders who execute orders in options are getting a tool that works based of their perception of the market – where it is and where it could be going. They are all free to use. Web trading platform – The online trading system for TD Ameritrade is sufficient for most passive investors. You can log in and view. Traders, brokers, and portfolio managers can manage their stocks better with TD Ameritrade. The app has features and functionalities that can help you. Learn how to leverage the thinkorswim platform and additional trading tools Charles Schwab Introduces “Schwab Trading Powered By Ameritrade”. Morning. HTML clipboard Because Ameritrade acquired thinkorswim (their brokerage platform) for $ millions in The Ameritrade simply prefer to. Comprehensive Trading Platform: TD Ameritrade API offers a comprehensive suite of trading tools and resources, including real-time market data, research and. The Schwab web trading platform is still there. I think OP is confusing the adoption of tos with the regular website. The world of financial markets is vast, and your choice of a brokerage platform can play a crucial role in shaping your investing and trading experience. With. Trading Platforms. TD Ameritrade offers its proprietary platform: Thinkorswim. This includes: Investing Platforms TD Ameritrade Mobile Trader; ThinkOrSwim. Thinkorswim is a trading platform provided by TD Ameritrade, designed to offer a variety of tools, resources, and information to assist traders. From stocks to. Thinkorswim is the advanced trading platform geared towards active traders, while TD Ameritrade offers broader brokerage services, including IRA accounts. TD Ameritrade trading is a publicly traded online brokerage that serves both consumers and institutions looking to invest in the stock market. November - Established a trading link with SK Securities, allowing SK Securities clients to trade U.S. securities via the Ameritrade platform. August -- AT&T. thinkorswim is TD Ameritrade's flagship trading platform that offers a plethora of sophisticated charting tools, customization features, and much more. As with any company, the reviews and ratings online vary, depending on each customer's experience. Customers appear to be generally pleased with TD Ameritrade.

Being A Day Trader On Robinhood

One important distinction about Robinhood is that you cannot short sell. If you're looking to short stocks, Robinhood is not the broker. This may be their way. As one of the few places to trade options commission free, Robinhood deserves a spot on the list. It also offers fractional share investing, cryptocurrencies. Day trade calls are industry-wide regulatory requirements and are not unique to Robinhood. The brokerage counts your account balance at the end of the previous trading day, so if you want to be a pattern day trader with Robinhood, you will need to. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission fees. Other fees may apply*. Swing trading may be a viable option with Robinhood. One thing to keep in mind is that the free commissions are nice, but if commissions. Pattern Day Trade Protection | Robinhood. Account Restriction: Once marked as a pattern day trader on Robinhood, your account will be subject to certain restrictions. · Day-Trading Buying. This Day Trading Risk Disclosure Statement applies to all margin accounts. Cash accounts are not subject to day trading rules. Robinhood Financial LLC and. One important distinction about Robinhood is that you cannot short sell. If you're looking to short stocks, Robinhood is not the broker. This may be their way. As one of the few places to trade options commission free, Robinhood deserves a spot on the list. It also offers fractional share investing, cryptocurrencies. Day trade calls are industry-wide regulatory requirements and are not unique to Robinhood. The brokerage counts your account balance at the end of the previous trading day, so if you want to be a pattern day trader with Robinhood, you will need to. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission fees. Other fees may apply*. Swing trading may be a viable option with Robinhood. One thing to keep in mind is that the free commissions are nice, but if commissions. Pattern Day Trade Protection | Robinhood. Account Restriction: Once marked as a pattern day trader on Robinhood, your account will be subject to certain restrictions. · Day-Trading Buying. This Day Trading Risk Disclosure Statement applies to all margin accounts. Cash accounts are not subject to day trading rules. Robinhood Financial LLC and.

Are you a Robinhood trader? Are you losing money? Commission free trades doesn't make day trading any easier. To be successful at day trading requires a. Day trading can be extremely risky—both for the day trader and for the brokerage firm that clears the day trader's transactions. Even if you end the day. Robinhood day traders should not be seen as traders or investors but rather speculators or gamblers. And as it is the case in % of the cases, gamblers loose. You don't need any money to do this. Number one, you get a broker job of your choice to trade on. Robin Hood is the complete easiest. If you're like stupid, get. You need to have more than 25k in your account for daytrading, and with robinhood as a day trader, you can only do cash trading, which means you. The Pattern Day Trading (PTD) Rule applies at Robinhood. According to FINRA rules, you are a day trader if you execute at least four day trades within five. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Interestingly, crypto portfolio value in Robinhood will not be counted towards 25k minimum requirement. The restricted accounts may find themselves in a. If you use Robinhood for investing, you may be wondering how to disable the pattern day trade protection. This feature allows you to monitor how many. No matter how you choose to day trade, you need to know all about the stock and the company behind it. One of the pitfalls of Robinhood day trading can be lack. Robinhood. U.K. Ltd and Robinhood Securities, LLC (collectively, “Robinhood”) DO NOT PROMOTE DAY. TRADING. Investors should consider their investment objectives. Day trade calls are industry-wide US regulatory requirements and are not unique to Robinhood. Robinhood limits day trading for traders at 3 times in a 5 business day period. This means You'll be considered a pattern day trader if you. THE PROS AND CONS OF DAY TRADING ON ROBINHOOD · Execution quality — Robinhood routes orders through market makers for payment, leading to. Robinhood and Charles Schwab have made it easier than ever for retail investors to trade. Day trading can be lucrative, as long as you do it properly. Day trading on Robinhood can be an exciting way to potentially profit from short-term market movements. However, the Pattern Day Trader. Yes, Robinhood can be used for day trading but with a few restrictions. Under the SEC rules, the minimum required account balance for day trading is $25, As one of the few places to trade options commission free, Robinhood deserves a spot on the list. It also offers fractional share investing, cryptocurrencies. Robinhood has specific rules they use to protect investors. One of the big ones is the pattern day trading (PDT) rule. If you day trade, you may be familiar. Robinhood: Robinhood is a platform that offers commission-free stock trading, which makes it great for beginners who want to avoid incurring significant.

Where To Put Money To Grow

It can be a lucrative way to grow your investment portfolio, but it comes with serious risks. But before you put all of your money into dividend stock, it's. Betterment can help grow your money by making saving and investing easy. Invest in a tailored portfolio, set buckets for your goals, and earn rewards. If you just put it into a CD at 5 % + that would be best. Issue is that you have a short time horizon and doing nothing you're mostly to your. Investing is an effective way to put your money to work and potentially build wealth. An increase in risk may provide more potential for your money to grow. For instance, you might choose to top up your pension, save for a dream vacation, and set up an ISA for a house deposit. When not to save or invest. There are. Step 2: Why do people invest? If you have savings and you'd like to try to grow your money over the long term, then you could consider investing some of it. money grow! Ideal if you want: Hands-off, automatic investing; To easily track your money from anywhere; A personalized investment portfolio2 made up of low. By investing, you are deciding where to put your money, where it will grow and provide additional funds to help you achieve your goals. It is never too late. You can invest in an ETF for less than $, while mutual funds often ask you to invest at least $1, A share of stock can range in price from a few dollars. It can be a lucrative way to grow your investment portfolio, but it comes with serious risks. But before you put all of your money into dividend stock, it's. Betterment can help grow your money by making saving and investing easy. Invest in a tailored portfolio, set buckets for your goals, and earn rewards. If you just put it into a CD at 5 % + that would be best. Issue is that you have a short time horizon and doing nothing you're mostly to your. Investing is an effective way to put your money to work and potentially build wealth. An increase in risk may provide more potential for your money to grow. For instance, you might choose to top up your pension, save for a dream vacation, and set up an ISA for a house deposit. When not to save or invest. There are. Step 2: Why do people invest? If you have savings and you'd like to try to grow your money over the long term, then you could consider investing some of it. money grow! Ideal if you want: Hands-off, automatic investing; To easily track your money from anywhere; A personalized investment portfolio2 made up of low. By investing, you are deciding where to put your money, where it will grow and provide additional funds to help you achieve your goals. It is never too late. You can invest in an ETF for less than $, while mutual funds often ask you to invest at least $1, A share of stock can range in price from a few dollars.

Wealthfront is designed to build wealth over time. Earn % APY on your uninvested cash, invest in a ladder of US Treasuries, and diversify for the long. You can invest in an ETF for less than $, while mutual funds often ask you to invest at least $1, A share of stock can range in price from a few dollars. Despite putting in three times as much money, your friend's account grows to only. $, You can start small and grow. Even setting aside a small portion of. Regular savings accounts. Put a small sum of money aside on a monthly basis into some of the highest-paying accounts out there. Kenneth Chavis IV, CFP and senior wealth manager at LourdMurray, suggests money market funds "for those who are not comfortable with investment risk but want to. Owning high-yield savings accounts: certificates of deposit (CDs), stocks, mutual funds, annuities and individual development accounts. Owning real estate. deposit so that you have more money to grow over time. But just how much of Everyone has a different process, but starting with the end result can help you. + INVEST FOR YOUR KIDS - Start investing for your kids' futures with Acorns Early, an UTMA/UGMA investment account. + TEACH YOUR KIDS' MONEY SKILLS - Grow your. Automating your savings is another good way to ensure you put money aside regularly · Here is a list of banks offering high-yield savings accounts. Keep cash savings in an accessible savings account for any life milestones coming up in the next two years. This way, explains Todd, you are not stuck waiting. Acorns helps you save & invest. Invest spare change, bank smarter, earn bonus investments, and more! Get started. Interest is: An amount of money banks or other financial institutions pay you for keeping money on deposit with them; Expressed as a percentage; Calculated. A savings account · A certificate of deposit (CD), which locks in your money for a fixed period of time at a rate that is typically higher than that of a savings. Acorns helps you invest and save for your future. With nearly $4,,, in Round-Ups® invested and counting, we are an ultimate investing. Longer wait to access invested funds. When you invest your money, depending on the type of investment, it may take longer to access your money compared to a. When you think about where to keep your hard-earned cash, checking and savings accounts may come to mind first. These are solid options, but money market. Saving vs investing. Save or invest? Invest or save? It's easy to end up going around in circles when trying to decide on the best. Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals. Consider putting it in a high yield savings or money market account, which typically earn more interest than a traditional savings account. Having an emergency.

1 2 3 4