irk-ajur.ru Learn

Learn

Can You Purchase A House With Bad Credit

Can I Buy A Home With A Low Credit Score? · If you have bad credit and you're nervous that you won't be able to be approved when applying for a mortgage, don't. What is a low credit score for buying a house? · Poor: or below · Fair: to · Good: to · Very Good: to · Excellent: +. Can someone with poor credit and a lot of money saved up still buy a house? Sure. If you have a VERY LARGE down. How to get a mortgage with a low or bad credit score · Your credit score. · The amount of debt you carry compared to the income you receive, also called your debt. Traditionally home loans for bad credit borrowers fell to the risky subprime mortgage lender. How to get a home equity loan with poor credit to should determine. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Some programs, such as FHA loans, can make it easier to buy a home with poor credit. However, if you have particularly poor credit (less than a ), you'll. Alex will provide you with a variety of mortgage options after bankruptcy or with a poor credit score. GET STARTED. Start Your Bad Credit Mortgage. Alex. If you have a low credit score, some lenders will require a higher downpayment. If you don't have money for a downpayment, sit down with your Texas Realtor and. Can I Buy A Home With A Low Credit Score? · If you have bad credit and you're nervous that you won't be able to be approved when applying for a mortgage, don't. What is a low credit score for buying a house? · Poor: or below · Fair: to · Good: to · Very Good: to · Excellent: +. Can someone with poor credit and a lot of money saved up still buy a house? Sure. If you have a VERY LARGE down. How to get a mortgage with a low or bad credit score · Your credit score. · The amount of debt you carry compared to the income you receive, also called your debt. Traditionally home loans for bad credit borrowers fell to the risky subprime mortgage lender. How to get a home equity loan with poor credit to should determine. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Some programs, such as FHA loans, can make it easier to buy a home with poor credit. However, if you have particularly poor credit (less than a ), you'll. Alex will provide you with a variety of mortgage options after bankruptcy or with a poor credit score. GET STARTED. Start Your Bad Credit Mortgage. Alex. If you have a low credit score, some lenders will require a higher downpayment. If you don't have money for a downpayment, sit down with your Texas Realtor and.

The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Don't worry – it's still possible to own a home even with a low credit score. In this article, we'll go over all the options for buying a house with bad credit. These and a host of other credit related issues can be overcome by working with bad credit mortgage lenders that specialize in mortgage loans with poor credit. Utah Bad Credit Mortgage Loan Poor credit can limit home buying options, but it does not disqualify you from home ownership. Having poor credit can make the. Speak to a lender as they will tell you exactly what you may need to work on as far as credit after reviewing your credit report. As far as low. Unfortunately, if you have a bad credit score, you may have a more difficult time qualifying for a mortgage through a traditional lender. If you have bad credit, you may still be able to buy a house through alternative financing options such as FHA loans, VA loans, USDA loans, or. A bad score would be in the Poor to the low Fair range. Under Poor; Fair; Good; Very Good; +: Exceptional. Banks refuse mortgages for Americans with a poor FICO score. Bad credit occurs for many reasons. Maybe identity theft or high medical bills caused the issue? Buying a home with bad credit can be a challenge, but it is far from impossible. With more than 20 years of experience in the Central Florida area, you can. Many lenders will approve mortgages for qualified borrowers with bad credit. A few lenders even specialize in mortgages for homebuyers with a low credit score. Don't Let Bad Credit Keep You From Homeownership. If your minimum score is too low for an FHA loan, you may still qualify for conventional loans with a low. Even bad credit mortgage lenders will look more favourably on you if your poor score is higher than others applying for the same loan. It is important to also. It is also very common for borrowers with poor credit to need the help of down payment assistance programs. Again, the ability to apply for these is a benefit. Some lenders specifically make loans for bad credit available but those may only make sense in certain circumstances. Home Loan Options for Borrowers with Poor. A bad credit score doesn't have to prevent you from owning a home. Learn how to get a home loan with poor credit by following the tips in this quick guide. FHA Loans—Your Loan Option for Bad Credit · Credit score as low as with 10% down or as low as with % down · Debt-to-income (DTI) ratio of 43% or less1. Here are a few of the most common bad credit loan examples for homeowners, along with how long you'll need to wait to buy another home. Mortgage Write Off. Also. Looking for information about Bad Credit Mortgage? Our brokers are online if you have any questions you can't finance more than 75% of the home's appraised. Some lenders specifically make loans for bad credit available but those may only make sense in certain circumstances. Home Loan Options for Borrowers with Poor.

Trading Trailing Stop

A trailing stop order is a specific type of stop-loss that automatically follows your position if the market rises, securing your profit. A trailing stop is an excellent method with which forex and CFD traders can either minimize their potential losses on a position, or secure potential earnings. Trailing Stops. Traders can enhance the efficacy of a stop-loss by pairing it with a trailing stop, which is a trade order where the stop-loss price isn't fixed. There are two types of trailing stops: A dynamic trailing stop is the most common trailing stop. This will adjust our stop every pip that the trade moves in. YOWL is currently trading at $ per share. Your stop price will start at $, which is 5% higher than the current price of YOWL. If YOWL stays between. A trailing stop loss is a stop order that automatically follows the price of an asset towards an open trade at a distance specified in the parameters and stops. A trailing stop order lets you track the price of a stock before triggering a market order if the stock reaches the trailing stop price. For day trading a static trailing stop is generally a bad idea, you will likely be stopped out prematurely and throw off your R/R. How does a trailing stop work? Trailing stops help to lock in profits while keeping the trade open until the instrument's price hits your trailing stop level. A trailing stop order is a specific type of stop-loss that automatically follows your position if the market rises, securing your profit. A trailing stop is an excellent method with which forex and CFD traders can either minimize their potential losses on a position, or secure potential earnings. Trailing Stops. Traders can enhance the efficacy of a stop-loss by pairing it with a trailing stop, which is a trade order where the stop-loss price isn't fixed. There are two types of trailing stops: A dynamic trailing stop is the most common trailing stop. This will adjust our stop every pip that the trade moves in. YOWL is currently trading at $ per share. Your stop price will start at $, which is 5% higher than the current price of YOWL. If YOWL stays between. A trailing stop loss is a stop order that automatically follows the price of an asset towards an open trade at a distance specified in the parameters and stops. A trailing stop order lets you track the price of a stock before triggering a market order if the stock reaches the trailing stop price. For day trading a static trailing stop is generally a bad idea, you will likely be stopped out prematurely and throw off your R/R. How does a trailing stop work? Trailing stops help to lock in profits while keeping the trade open until the instrument's price hits your trailing stop level.

A trailing stop provides a fluid approach to trade management. It's a dynamic stop loss order that moves in relationship to evolving price action. After opening. The Trailing Stop order option is an advanced order setting that is used with a Stop Market order type. This allows you to set a trailing stop to a specified. As their name suggests, stop loss orders are used to prevent large losses and to preserve your trading capital by automatically closing your open position once. A trailing stop allows a trade to continue to gain in value when the market price moves in a favourable direction, but automatically closes the trade if the. A Trailing Stop order is a stop order that can be set at a defined percentage or amount away from the current market price. In this case, a “limit” prevents the broker from executing a trailing stop trade “at the market”, and would keep you in the stock if the stock suddenly crashed. Select Trading from the menu · Select an Account · Choose your Action · In the Symbol field, enter a symbol or company name · Enter the Quantity · For your Order. Trailing Stop is placed on an open position, at a specified distance from the current price of the financial instrument in question. What is a trailing stop and how to use it in trading strategies? A complete guide for beginners including concept, use on MT4 and MT5, advantages and. Trailing stop orders are stop orders that adjust in price with favorable market movement on the security. They follow the same trading principles and mechanics. A trailing stop is a stop that automatically adjusts to market movement. This means it will follow your position when the market moves in your favor. The trader said the average person could make a lot more money if they took all of their money and set 1% or 2% trailing stop losses on their. A trailing stop order is a type of conditional stop order that is set to trigger at a specific percentage or dollar amount away from a security's current. A trailing stop order is a type of order that automatically adjusts the stop loss level as the market moves in your favor. Why is it important to consider a trailing stop when trading? A trailing stop enables you to protect a position, without the risk of taking profits too early. Growlonix is one such crypto trading platform that allows its traders to place trailing stop orders smartly in the best possible way. Table of Contents. Why is it important to consider a trailing stop when trading? A trailing stop enables you to protect a position, without the risk of taking profits too early. A trailing stop order is a type of order used in trading that allows traders to set a stop loss at a certain percentage or dollar amount below the market's. A Trailing Stop is a type of stop loss order that automatically adjusts its stop price as the market moves in a favorable direction. This allows traders to lock.

How Much Does The Average American Pay For Car Insurance

How much is car insurance per month and per year? The average cost of car insurance is $ per year for drivers with minimum coverage and a clean record. Why do you need car insurance? If you're involved in a covered accident, Allstate car insurance can help pay medical bills, vehicle repairs and legal. The national average cost of car insurance is $ per year, or $ per month. Discover how rates vary by driver age, profile and geographic location. Drivers who buy full-coverage car insurance pay an average of $ per month, or $2, per year. As a driver, your exact insurance costs will depend on various. Male 47 living near Houston TX $ a month full coverage including uninsured motorist but with a $ deductible. They were the lowest for me. American Family auto insurance. How Much is American Family Car Insurance? Our market analysis found that the average annual cost of full coverage car. Fixed costs (ownership costs) include insurance, license, registration, taxes, depreciation, and finance charges. Source: American Automobile Association. Generally speaking, the average cost is about $1, However, this number can only tell drivers so much because different states all have their own average car. The report found that nationwide, American consumers with clean driving records and excellent credit pay an average annual premium of $ for state-mandated. How much is car insurance per month and per year? The average cost of car insurance is $ per year for drivers with minimum coverage and a clean record. Why do you need car insurance? If you're involved in a covered accident, Allstate car insurance can help pay medical bills, vehicle repairs and legal. The national average cost of car insurance is $ per year, or $ per month. Discover how rates vary by driver age, profile and geographic location. Drivers who buy full-coverage car insurance pay an average of $ per month, or $2, per year. As a driver, your exact insurance costs will depend on various. Male 47 living near Houston TX $ a month full coverage including uninsured motorist but with a $ deductible. They were the lowest for me. American Family auto insurance. How Much is American Family Car Insurance? Our market analysis found that the average annual cost of full coverage car. Fixed costs (ownership costs) include insurance, license, registration, taxes, depreciation, and finance charges. Source: American Automobile Association. Generally speaking, the average cost is about $1, However, this number can only tell drivers so much because different states all have their own average car. The report found that nationwide, American consumers with clean driving records and excellent credit pay an average annual premium of $ for state-mandated.

The report found that nationwide, American consumers with clean driving records and excellent credit pay an average annual premium of $ for state-mandated. That puts average monthly car payments at $, $ and $, respectively. The price of used cars and trucks decreased. Used car and truck prices are down a. $/Month for full coverage here. All insurance rates are disgusting right now, my car and home insurance both gone up significantly. The national average cost for full coverage car insurance is $2, per year, or $ per month. Drivers with minimum coverage pay an average of $ a year, or. The amount you'll pay for car insurance is impacted by a number of very different factors—from the type of coverage you have to your driving record to where. The average cost of auto insurance in the U.S. is $ for a six-month policy. But car insurance rates depend on a number of factors — let's dive into the. The amount you'll pay for car insurance is impacted by a number of very different factors—from the type of coverage you have to your driving record to where. Do your car insurance costs decrease once your car is paid off? Your car insurance premiums won't automatically decrease when you pay off your car loan. But if. Annual average insurance costs inched up to $1, per year, a $5 increase. How Much Does It Cost To Paint a Car? How much it costs to paint a car. The average American spends $ a month on expenses and bills. Learn how you measure up and how you may reduce your monthly expenses. Currently, the average American spends $ per month or $1, per year. The cost of car insurance alone might not seem like such a monumental. How much is the average cost of car insurance in the U.S? The average cost for car insurance in the United States is $1, per year, or $ per month. The average full-coverage insurance cost for medium sedans was $1,, compared with $1, for a medium SUV. The average insurance cost for all vehicles. Top Auto Loan Statistics In The United States (): · The average monthly automobile payment in the United States is $ for a new car. · $ is the typical. Average American Spending per Day: All Ages ; Vehicle Insurance, $ ; Eating Out, $ ; Alcohol, $ ; Entertainment, $ ; Cellphone Service, $ Find out how much car insurance costs based on your age and state. Average car insurance rates by age group range from $ per year for year-old drivers. How much does the average person spend on their car per month, excluding maintenances and insurance costs? How much do you pay for car. Its most recent data ( midyear) provide the average annual expenditure on auto insurance for white, African-. American, and Hispanic households. These. The average car insurance payment is between $40 and $ monthly. Factors that affect auto insurance rates include personal variables like age, gender, marital. Michigan auto insurance costs, on average, about $2, annually for a full coverage policy. The average price of a full coverage car insurance policy in the.

How To Find Out My California Id Number

If your ID card hasn't arrived after 60 days, call the DMV at to check the status of your application. You will need to have your receipt number. Get proof of your identity (check here for the different ways to prove your identity). Get proof of residency (which could be with school records or a letter. Complete a Driver's License (DL) or ID Card Application. · Visit a DMV office, where you will: Provide your social security number (SSN). Verify your identity. Right now, only people who can show their presence in the U.S. is “authorized under federal law” can apply for a standard (non-REAL ID) California. We have separate locations for driver and vehicle licensing. Be prepared to make 2 trips to the different office locations. Are you REAL ID ready? · Are you planning to fly domestically or visit a Federal facility after May 7, ? · Yes / Don't Know. Does your Drivers License / ID. A REAL ID driver license and ID card will have a special marking in the top right corner of the card. The marking is the California grizzly bear with a star. A California driver must visit your local CA DMV field office to apply for your ID card in order to: Fill out Application (Form DL) for Driver Licenses/. You will receive your new ID card via mail within weeks. If you have not received your new ID card after 60 days, call DMV at to check the. If your ID card hasn't arrived after 60 days, call the DMV at to check the status of your application. You will need to have your receipt number. Get proof of your identity (check here for the different ways to prove your identity). Get proof of residency (which could be with school records or a letter. Complete a Driver's License (DL) or ID Card Application. · Visit a DMV office, where you will: Provide your social security number (SSN). Verify your identity. Right now, only people who can show their presence in the U.S. is “authorized under federal law” can apply for a standard (non-REAL ID) California. We have separate locations for driver and vehicle licensing. Be prepared to make 2 trips to the different office locations. Are you REAL ID ready? · Are you planning to fly domestically or visit a Federal facility after May 7, ? · Yes / Don't Know. Does your Drivers License / ID. A REAL ID driver license and ID card will have a special marking in the top right corner of the card. The marking is the California grizzly bear with a star. A California driver must visit your local CA DMV field office to apply for your ID card in order to: Fill out Application (Form DL) for Driver Licenses/. You will receive your new ID card via mail within weeks. If you have not received your new ID card after 60 days, call DMV at to check the.

Get Outdoors Identification (GO ID) number. Your GO ID will print on all your licenses and is used to help you track purchases, preference points, and. the federal government to board domestic flights, or to access some federal facilities starting on May 7, If you use your driver license or ID card to get. The California Identification Card (CAL-ID) Program provides a California Identification card to eligible inmates upon their release from prison with the. The law allows individuals experiencing homelessness to: Receive a certified copy of his/her birth certificate from the County Registrar's Office (in the county. You go to the local DMV office (Department of Motor Vehicles). You should book an appointment to do this. Get the forms from online. The easiest way to find your company's Employer Identification Number (EIN) in California is to locate a previously filed tax return for your business entity. CALIFORNIA STATE ID The California State ID card is accepted at banks, stores, airports (for domestic flights only), and other businesses where name and age. As a member of the Alliance, you will get an Alliance Member ID card. Your Member ID card contains important information. Businesses that generate waste on an ongoing basis must have a permanent ID number. To get a permanent ID number, you need to complete the required application. Visit your local California DMV. • Complete a Driver License or Identification Card Application (Form DL 44). • Provide proofs of your ID, SSN, birth date. Real ID is a new kind of identification card issued by the California DMV that requires more proof of identity / residence to obtain. There are 2 types of California state ID cards: (1) regular state ID cards, which are good for 6 years, and (2) senior state ID cards, for people 62 years and. If you are eligible, the program will give you a completed Verification for Reduced Fee Identification. Card (DL ) form to take to DMV office. See your local. Transfer and Articulation System for. California's colleges and universities · Course numbering process to ease the transfer and articulation burdens in. Lastly, find your nearest CA DMV and either walk in or schedule an appointment. During your visit, you'll need to: After completing all of these steps, the. Businesses that generate waste on an ongoing basis must have a permanent ID number. To get a permanent ID number, you need to complete the required application. If you have an expired driver's license card issued by the same licensing agency, you will be relieved to learn that it has the same license. You may need to disable your computer's pop-up blocker to view the report. If you are requesting reactivation of your California ID number, your request will be. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at The hours of operation are a.m. - p.m. local time.

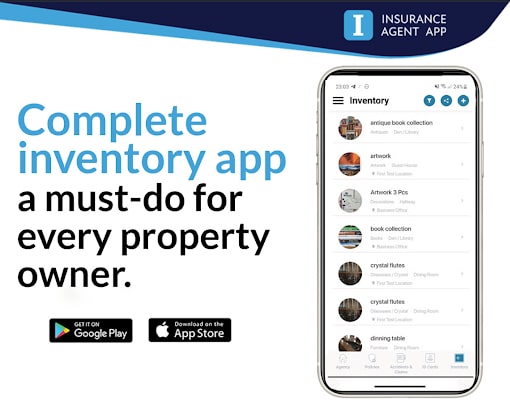

Home Insurance Inventory App

The free National Association of Insurance Commissioners (NAIC) Home Inventory App makes it easy to create and protect a record of your belongings and. Homeowners Insurance · Condos & Co-ops · Renters Insurance to your inventory, try using an inventory app or home management software, such as HomeZada. The apps being reviewed today are Nest Egg and Sortly. After looking at many apps, these two are our favorites on iOS for Apple and the Google Play Store for. This is a personal, home inventory app. Not a business inventory tracker. The most important features for me are the: make. and model, and serial numbers data. The National Association of Insurance Commissioner's (NAIC's) Home Inventory App lets you quickly capture images, descriptions, bar codes and serial numbers of. An Apple Mac App Store Editors' Choice & called “Quick and easy to use” by the New York Times, Home Inventory is the ultimate tool to document your home. An Apple Mac App Store Editors' Choice & called “Quick and easy to use” by the New York Times, Home Inventory is the ultimate tool to document your home. Use HomeManage to maintain a home inventory of all your possessions. · Terrific for Insurance Claims! Have a record of each item you own in case you need to make. The NAIC Home Inventory App makes it easy for you to upload photos and scan barcodes to quickly create a record of all your belongings. The free National Association of Insurance Commissioners (NAIC) Home Inventory App makes it easy to create and protect a record of your belongings and. Homeowners Insurance · Condos & Co-ops · Renters Insurance to your inventory, try using an inventory app or home management software, such as HomeZada. The apps being reviewed today are Nest Egg and Sortly. After looking at many apps, these two are our favorites on iOS for Apple and the Google Play Store for. This is a personal, home inventory app. Not a business inventory tracker. The most important features for me are the: make. and model, and serial numbers data. The National Association of Insurance Commissioner's (NAIC's) Home Inventory App lets you quickly capture images, descriptions, bar codes and serial numbers of. An Apple Mac App Store Editors' Choice & called “Quick and easy to use” by the New York Times, Home Inventory is the ultimate tool to document your home. An Apple Mac App Store Editors' Choice & called “Quick and easy to use” by the New York Times, Home Inventory is the ultimate tool to document your home. Use HomeManage to maintain a home inventory of all your possessions. · Terrific for Insurance Claims! Have a record of each item you own in case you need to make. The NAIC Home Inventory App makes it easy for you to upload photos and scan barcodes to quickly create a record of all your belongings.

Home Organizing Inventory Software. · Create a digital inventory for your belongings and valuables. · Track your belongings with ease. · Sortly home inventory. Encircle appears to be the Cadillac of the free home inventory apps. Simple to use, this app allows you to upload unlimited photos and notes about each room and. Having an up-to-date home inventory will help you get your insurance claim settled faster, verify losses for your income tax return and help you purchase. insurance claim. Add photos and receipts to your items, which can serve as proof of possession. This app can now save your data to OneDrive so that your. A home inventory guide is available to all consumers through the Department of Insurance by calling us at or downloading here: Home Inventory. Blue Plum Home Inventory will help you make and maintain a home inventory for any property you own. It lets you organize your belongings in collections. The first thing that comes to mind is grocy. It's originally/primarily designed to track household grocery inventory, but looks flexible enough. The sleek and easy-to-use Encircle Home Inventory App works great on iPhones and Android devices, and also via a Web portal. You can organize items by room and. Add photos of the rooms and contents in your home to create your personal home inventory. Even if you never have a loss, you can use it to get organized. 1. Encircle Best overall for its intuitive and fast setup, Encircle allows you to create a visual inventory, home by home and room by room. 1. Sortly Sortly is an app-based management software that allows you to keep track of your home inventory. With this program, you snap photos of your. Homeowner AI Makes a Home Inventory Easy Homeowner AI is the fastest and most accurate inventory saving you time and providing peace of mind. Home inventory. Itemlist is the best home inventory app for insurance because it lets you easily record your possessions with photos. You can also sync and access your data. 1. Sortly Sortly is an app-based management software that allows you to keep track of your home inventory. With this program, you snap photos of your. Home Contents 4+. house inventory & valuation. CURLYBRACE APPS LTD. • Ratings. NOTE: You can also use the UPHelp Home Inventory App to create your contents inventory after a loss. You can build your list with information from memory, any. Use HomeManage to maintain a home inventory of all your possessions. Terrific for Insurance Claims! Have a record of each item you own in case you need to. Nest Egg is the easiest way to manage your home inventory. We designed Nest Egg with the most simplified data entry, intuitive layouts and super-easy data. Do you have enough insurance coverage for everything in your home? Use this guide to taking a home inventory to find out.

Mortgage Refinance Apr

National year fixed refinance rates go down to %. The current average year fixed refinance rate fell 17 basis points from % to % on Friday. What are current mortgage refinance rates? Find and compare today's refinancing rates in your area. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. You might lower your rate and payment by refinancing your home! With a Conventional loan, you can get a competitive interest rate when you have good credit and. (REFER TO PURCHASE RATE SHEET FOR PURCHASE RATES) ; FHA - Fixed-Rate Mortgages · Fixed-Rate Mortgages: FHA · % % %, % ; Fixed-Rate Mortgages. Check today's mortgage rates for refinancing to get cash out, pay your mortgage off faster and more. Connect with us to estimate your personalized rate. Refinancing your mortgage means replacing an existing home loan with a new one. You usually follow the same steps you did to apply for your purchase mortgage. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. National year fixed refinance rates go down to %. The current average year fixed refinance rate fell 17 basis points from % to % on Friday. What are current mortgage refinance rates? Find and compare today's refinancing rates in your area. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. You might lower your rate and payment by refinancing your home! With a Conventional loan, you can get a competitive interest rate when you have good credit and. (REFER TO PURCHASE RATE SHEET FOR PURCHASE RATES) ; FHA - Fixed-Rate Mortgages · Fixed-Rate Mortgages: FHA · % % %, % ; Fixed-Rate Mortgages. Check today's mortgage rates for refinancing to get cash out, pay your mortgage off faster and more. Connect with us to estimate your personalized rate. Refinancing your mortgage means replacing an existing home loan with a new one. You usually follow the same steps you did to apply for your purchase mortgage. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %.

An escrow (impound) account is required. The rate lock period is 60 days and the assumed credit score is At a % interest rate, the APR for this loan. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. When you refinance, you apply for a new mortgage to pay off your current one. Most people refinance to take advantage of lower rates, get lower monthly payments. With a rate and term refinance loan with Ruoff Mortgage, you could lower your interest rate or reduce the length of your mortgage. Compare rates for the refinance loan options below. The following tables are updated daily with current refinance rates for the most common types of home loans. Refinancing your mortgage can provide you with lower interest rates, lower monthly payments, better loan terms, or can allow you to access your home's equity. Today's Mortgage Rates. Mortgage rates change daily based on the market. Here are today's mortgage rates. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. The average year fixed mortgage rate fell to % from % a week ago. Compared to a month ago, the average year fixed mortgage rate is down by Current Mortgage Refinance Rates As of September 6, , the average mortgage refinance APR is %. Terms Explained. Explore today's mortgage refinancing rates and compare loan options to see if home refinancing is right for you. Learn more here. The APR will be between % APR and % APR for first liens and % APR and % APR for second liens based on loan amount and a review of credit-. Today's competitive refinance rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Here are today's refinance rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. See current mortgage refinance rates from Discover Home Loans. Low fixed rate loans come with $0 application fees, $0 origination fees, $0 appraisal fees. MORTGAGE REFINANCE RATES ; Term, Rate, APR, Principal & Interest Payment ; 15 Yr Fixed Refinance, %, %, $1, ; 30 Yr Fixed Refinance, %, %. Customized mortgage rates ; 7/6 ARM, % (%), $2, ; year fixed, % (%), $ ; year fixed, % (%), $ ; year fixed, % . Are you thinking of refinancing your home mortgage? Chase offers competitive mortgage refinance rates. See which of the current refinance rates work for. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best.

What Information Do You Need To Prequalify For A Mortgage

You'll need to complete a mortgage application and provide documentation, such as recent pay stubs, bank statements and tax returns. The lender will also. In a pre-approval, you need to fill out a mortgage application. Application Fees. You do not typically need to pay any application fee during pre-qualification. Current address · Previous address (if current address is less than 3 years) · Current employment information (e.g. employer's address, telephone number). It's possible to get a conditional pre-approval by self-reporting your financial info, but you will need to submit documents to get a full pre-approval. A. Proof of employment and income · W-2s from the last two years. · Tax returns from the last two years. · Bank statements from the past three months (including. You may not need prequalification or preapproval in some cases. It's possible to be in a situation where you don't need a loan to buy a home or you're securing. They'll only need to confirm your address, identity and income. The verification of these details is usually quite loose and varies between lenders. For a preapproval, you'll have to submit information like your total monthly expenses, W2s, pay stubs, and if you already own property, your mortgage statement. Here would be my list for you: Letter of employment - recent paystub - T4 or year end paystub - T4 - proof of down payment (Bank accounts. You'll need to complete a mortgage application and provide documentation, such as recent pay stubs, bank statements and tax returns. The lender will also. In a pre-approval, you need to fill out a mortgage application. Application Fees. You do not typically need to pay any application fee during pre-qualification. Current address · Previous address (if current address is less than 3 years) · Current employment information (e.g. employer's address, telephone number). It's possible to get a conditional pre-approval by self-reporting your financial info, but you will need to submit documents to get a full pre-approval. A. Proof of employment and income · W-2s from the last two years. · Tax returns from the last two years. · Bank statements from the past three months (including. You may not need prequalification or preapproval in some cases. It's possible to be in a situation where you don't need a loan to buy a home or you're securing. They'll only need to confirm your address, identity and income. The verification of these details is usually quite loose and varies between lenders. For a preapproval, you'll have to submit information like your total monthly expenses, W2s, pay stubs, and if you already own property, your mortgage statement. Here would be my list for you: Letter of employment - recent paystub - T4 or year end paystub - T4 - proof of down payment (Bank accounts.

Pre-qualifying can nonetheless be helpful when it comes time to make an offer. "A pre-qualification letter is all but required with an offer in our market,". Personal identification: A driver's license will usually do, but some like to ask for social security information as well. Two years of tax returns: Your most. Lenders carefully review your credit report during pre-approval. They do this to identify and address any credit problems. They want you to resolve these. The key things necessary for pre-approval are proof of income and assets, good credit, verifiable employment, and documentation necessary for a lender to run a. Recent mortgage statement · Current homeowner insurance policy · Most recent property tax bill/statement · Legal description of property · Property Value. What information do I need to provide? ; Income information, Copies of pay stubs that show your most recent 30 days of income ; Credit check, Credit check ; Basic. A lender will typically review your credit history, current gross income, assets, and debts when granting a pre-approval. Paying down debts, saving for a larger. Find out why you were declined, so you can figure out what to do to improve your chances of getting a loan in the future. · Ask the lender to explain why you. To get a mortgage pre-approval, you, the borrower, must provide the mortgage lender with details about your finances. This information includes your income. Prequalification and preapproval are two tools to estimate how much you might be able to borrow to buy a home. With both, lenders take a preliminary look at. Mortgage prequalification is a simple process that uses your income, debt, and credit information to let you know how much you may be able to borrow. 1. Proof of Income and Employment You will obviously need to show lenders that you are not only employed but also that your income is sufficient enough. Copies of W-2 forms and your two most recent payroll stubs. If income includes overtime, bonuses or differential pay, you may need your most recent end-of-year. To complete the application, you will likely need to provide several pieces of documentation, including your W-2, bank statements, credit report and tax returns. You'll need to demonstrate steady employment, sufficient income to make your monthly mortgage payments and a healthy credit score. With a pre-approval, once a. When you apply for a verified preapproval, you'll be required to provide documentation about your financial history upfront. This allows us to verify the. When Should You Get Prequalified for a Mortgage? It's a good idea to get prequalified right before you begin your home search. That's because we use your. To get pre-approved, you'll need to verify your income, employment, assets and debts. You probably already have the records you'll need or easy access to them. You'll fill out a mortgage application typically online or over the phone. · To get preapproved you'll provide income documentation (paystubs. To complete the application, you will likely need to provide several pieces of documentation, including your W-2, bank statements, credit report and tax returns.

How To Start A Vineyard

Most productive vineyards in New Jersey benefit from supplemental moisture via irrigation during establishment years and periods of drought stress. Depending. Whatever your reasons for thinking about starting a grape vineyard, success in grape growing requires knowledge in all phases of plant production, pest. In Starting a Vineyard in Texas: A Guide for Prospective Grape. Growers, Kamas et al. () illustrate the importance of air drainage being a critical. Learning to grow and make your own. In The Organic Backyard Vineyard, expert Tom Powers walks the small grower through the entire process of growing grapes. vineyard resource. Wine Tannin management in the vineyard · Vineyard profitability. Downloads. Irrigation. How to start irrigating with less water (). As it was made in Israel (where they make a lot of fertilising equipment designed to conserve water), and was installed on the day the Israeli Prime Minister. In this article, we look at starting a wine business, from having your own winery to starting a wine shop or running a business online. Register Your Vineyard with the IRS; Open a Business Bank Account; Get a Business Credit Card; Get the Required Business Licenses and Permits; Get Business. If you want to plant grapes in the backyard to make wine, you'll need to take a few crucial steps first · Plant the right number of grape vines · Know your. Most productive vineyards in New Jersey benefit from supplemental moisture via irrigation during establishment years and periods of drought stress. Depending. Whatever your reasons for thinking about starting a grape vineyard, success in grape growing requires knowledge in all phases of plant production, pest. In Starting a Vineyard in Texas: A Guide for Prospective Grape. Growers, Kamas et al. () illustrate the importance of air drainage being a critical. Learning to grow and make your own. In The Organic Backyard Vineyard, expert Tom Powers walks the small grower through the entire process of growing grapes. vineyard resource. Wine Tannin management in the vineyard · Vineyard profitability. Downloads. Irrigation. How to start irrigating with less water (). As it was made in Israel (where they make a lot of fertilising equipment designed to conserve water), and was installed on the day the Israeli Prime Minister. In this article, we look at starting a wine business, from having your own winery to starting a wine shop or running a business online. Register Your Vineyard with the IRS; Open a Business Bank Account; Get a Business Credit Card; Get the Required Business Licenses and Permits; Get Business. If you want to plant grapes in the backyard to make wine, you'll need to take a few crucial steps first · Plant the right number of grape vines · Know your.

Decide first on how big you want your vineyard to be, so that you can choose a location that can accommodate that — too small can prevent you from expanding in. Ordered grade dormant vines or greenhouse-rooted green plants. Ordered grapevines a few weeks before planting. Page 2. Starting the Vineyard. Preparing the soil is a fundamental step in creating an environment that fosters healthy vine growth. Start by analyzing the soil composition and pH levels to. Images of fields of ripe grapes ready to be made into excellent wine are usually the beginning of a vineyard enterprise, but. This guide outlines the main factors to consider when establishing a commercial vineyard and suggests resources to assist in planning. Vineyard yields can be anywhere from 1 ton per acre to 12 tons per acre. One ton can produce gallons of wine, resulting in 65 cases of wine, or bottles. Winegrowers need to have a good understanding of the local soil composition and climate characteristics to set up a vineyard and grow the right grape varieties. Considerations Before Starting a Vineyard Business. Initial Investment, Estimated startup costs can range from $5, to $10, per acre, with additional costs. To expand our vineyard in we first had to remove rows of trees between two fields. The 'middle' row to simply make the vineyard field continuous. The. I want to start a vineyard. Where do I go for information? The University of Massachusetts Amherst has a Small Fruit Program. Information about the various. In this article, we look at starting a wine business, from having your own winery to starting a wine shop or running a business online. There is much to consider before establishing a vineyard, so use the resources below to help guide you through the planning process. The costs to start a vineyard can vary widely, but expect at least $30, — $50, per acre in upfront establishment costs, including land. Discing the top layer and vegetation back in to the soil. Then it is time to lay out the vineyard design, marking where each vine will sit. Installing the. Vineyard Funds · Buy Vineyards · Build deep contacts in the wine industry · Get help from experts · Where to buy a vineyard · Have a clear idea of what you want to. With an eye on profit, the program leads you through every aspect of developing a commercial vineyard, from site and variety selection, equipment, vineyard. A vineyard to be laid out in blocks is started by establishing a straight baseline. By choosing a base line, such as a fence or road the grower can establish a. Vine to Wine: Successfully Establishing a Vineyard or Winery – WSU #OM41 Please see the opening statement at the top of this page regarding WA. If you're opening a winery in a popular wine region, you'll be able to find just about anything you need somewhere close by. For this reason, you might want to. Nowadays no new vineyards are allowed, so the existing total vineyard If you need to level off bumpy land to make a flat vineyard, you'll have to.

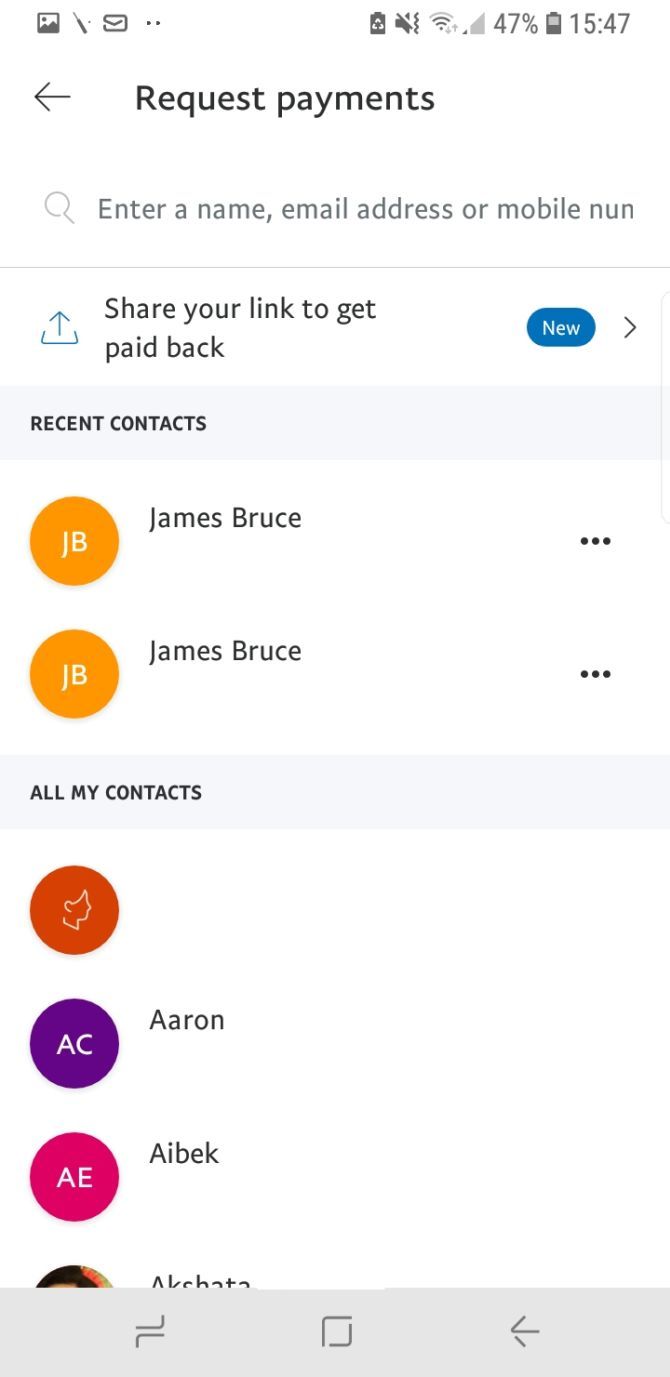

Send Money To Friends App

Xoom is the fast, safe, and reliable way to send money to friends and family abroad. We have you covered with: 24/7 transaction protection and fraud monitoring. 1. Paypal: Best overall · 2. Venmo: Best for sending money · 3. Cash App: Best if you like options · 4. Google Pay: Best for Google suite users · 5. Apple Pay: Best. Best apps to send money · Best for budding investors: CashApp · Best between friends: Venmo · Best for flexible payments: PayPal · Best for bank-to-bank transfers. Simply download the app, link your debit card, verify your identity and quickly transfer money to your friends and loved ones. Venmo is our number one choice for domestic transfers to friends and family, while Zelle is great for free domestic bank-to-bank transfers in particular. Cash. You may be able to send funds directly to your friend's Cash App account and routing numbers if they have a direct deposit account. Venmo is our number one choice for domestic transfers to friends and family, while Zelle is great for free domestic bank-to-bank transfers in particular. Cash. Use a money-transfer app. If you have the email or US mobile number of the recipient, you may be able to send money securely using an online service or app. Remitly helps you send money worldwide and pay using your bank account, credit card, or debit card. More money makes it home to friends and family thanks to. Xoom is the fast, safe, and reliable way to send money to friends and family abroad. We have you covered with: 24/7 transaction protection and fraud monitoring. 1. Paypal: Best overall · 2. Venmo: Best for sending money · 3. Cash App: Best if you like options · 4. Google Pay: Best for Google suite users · 5. Apple Pay: Best. Best apps to send money · Best for budding investors: CashApp · Best between friends: Venmo · Best for flexible payments: PayPal · Best for bank-to-bank transfers. Simply download the app, link your debit card, verify your identity and quickly transfer money to your friends and loved ones. Venmo is our number one choice for domestic transfers to friends and family, while Zelle is great for free domestic bank-to-bank transfers in particular. Cash. You may be able to send funds directly to your friend's Cash App account and routing numbers if they have a direct deposit account. Venmo is our number one choice for domestic transfers to friends and family, while Zelle is great for free domestic bank-to-bank transfers in particular. Cash. Use a money-transfer app. If you have the email or US mobile number of the recipient, you may be able to send money securely using an online service or app. Remitly helps you send money worldwide and pay using your bank account, credit card, or debit card. More money makes it home to friends and family thanks to.

You can easily send money fast with Google Pay. If your friends and family have PayNow, you can send them money without extra fees in a few seconds. Receive and send money for free with Cash App. Pay anyone in using a phone number, email, or $cashtag. Send and receive stocks and bitcoin, too. Remitly helps you send money worldwide and pay using your bank account, credit card, or debit card. More money makes it home to friends and family thanks to. Welcome to Venmo! Manage your account balance, send/receive money, split bills, pay friends, and stay connected with your network all in one place. Xoom is the fast, safe, and reliable way to send money to friends and family abroad. We have you covered with: 24/7 transaction protection and fraud monitoring. A fast and reliable money transfer app at your fingertips, 24/7. Send money, track money transfers, pay bills, review exchange rates and find agent locations. Collect money from your friends for that birthday present, sports event or anything you like. They don't even need to download an app, just tap to pay using. Xoom is the fast, safe, and reliable way to send money to friends and family abroad. We have you covered with: 24/7 transaction protection and fraud. To send money online to friends and family, you will have choices such as payment apps, wire transfer, and checks. Learn the pros and cons of each. 7 digital payment services that let you transfer money · PayPal · Zelle® · Venmo · Cash App · Meta Pay · Google Pay · Apple Cash · Money transfer services FAQ. A fast and reliable money transfer app at your fingertips, 24/7. Send money, track money transfers, pay bills, review exchange rates and find agent locations. Send and request money from friends, family and sellers around the world—quickly and securely. Raise funds and make donations. All in one app. A fast and easy way to send and receive money to almost anyone you know who has a bank account in the US right in your Chase Mobile app. If you're using PayPal to send money to friends or family domestically from your bank account, the service is free. If you're sending money via credit or debit. No banks, loan sharks, or predatory lenders when you borrow. Relationship-based loans are only between you and members of your community. Get the Zirtue app. Best apps to send money · Best for budding investors: CashApp · Best between friends: Venmo · Best for flexible payments: PayPal · Best for bank-to-bank transfers. Receive and send money for free with Cash App. Pay anyone in using a phone number, email, or $cashtag. Send and receive stocks and bitcoin, too. Payment apps make paying for your purchases and sending money to friends and family easier than it's ever been. Depending on your needs, PayPal is tops for. More ways to transfer money with Western Union® · Send money on the go with our app. Learn how to send money from the gym, grocery store or your workplace by. Apple Cash functions like mobile payment app rivals Venmo and Zelle to allow for cash transfers between those with an iPhone, iPad, or Apple Watch.

Cia Coin

A fantastic set of 7 quality coins you will receive one of each coin pictured in first photo. Pictures with two coins represent front and back of the coin. Shop By Price · New! · DOS / PRESIDENT SEAL Challenge Coin/Acrylic Case · DOS & USA CHALLENGE COIN in Acrylic Case · Easel Stand · DOS/Presidential Seal. This coin honors the CIA and its employees and is minted in a brass alloy, given an antique finish and imbued with the bold colors of the CIA emblem. Shop for Cia Challenge Coin at irk-ajur.ru Save money. Live better. Artifact Details. A silver coin depicting a Cuban rebel during the Bay of Pigs and dated April The Bay of Pigs was an ill-fated attempt to depose the. This Coins & Money item by CoinsForAnythingET has 23 favorites from Etsy shoppers. Ships from Fredericksburg, VA. Listed on Aug 22, CIA Covert Special Operations Clandestine Service Lethal HUMINT Challenge Coin. One World Treasures (); % positive feedback. Approx. C $ This Coins & Money item by JCoinsCollectibles has 68 favorites from Etsy shoppers. Ships from Sherman, IL. Listed on Aug 20, Central Intelligence Agency (CIA) Challenge Coin. Approx. C $ + C $ shipping. US $ Est. delivery Sat, Jul 27 - Tue, Jul A fantastic set of 7 quality coins you will receive one of each coin pictured in first photo. Pictures with two coins represent front and back of the coin. Shop By Price · New! · DOS / PRESIDENT SEAL Challenge Coin/Acrylic Case · DOS & USA CHALLENGE COIN in Acrylic Case · Easel Stand · DOS/Presidential Seal. This coin honors the CIA and its employees and is minted in a brass alloy, given an antique finish and imbued with the bold colors of the CIA emblem. Shop for Cia Challenge Coin at irk-ajur.ru Save money. Live better. Artifact Details. A silver coin depicting a Cuban rebel during the Bay of Pigs and dated April The Bay of Pigs was an ill-fated attempt to depose the. This Coins & Money item by CoinsForAnythingET has 23 favorites from Etsy shoppers. Ships from Fredericksburg, VA. Listed on Aug 22, CIA Covert Special Operations Clandestine Service Lethal HUMINT Challenge Coin. One World Treasures (); % positive feedback. Approx. C $ This Coins & Money item by JCoinsCollectibles has 68 favorites from Etsy shoppers. Ships from Sherman, IL. Listed on Aug 20, Central Intelligence Agency (CIA) Challenge Coin. Approx. C $ + C $ shipping. US $ Est. delivery Sat, Jul 27 - Tue, Jul

The price of Cat Intelligence Agency (CIA) is $ today with a hour trading volume of $ This represents a % price decline in the last The Central Intelligence Agency (CIA) is a civilian intelligence agency of the United States government. Its primary function is collecting and analyzing. 1. The rules of the game should be given or explained to everyone given a coin. It's rude to call out a challenge if you haven't broken down the way it works. A challenge coin is usually a metal coin or medallion, bearing an organization's insignia, emblem or logo and carried by the organization's members. The price of CIA (CIA) is $ today with a hour trading volume of $ This represents a - price increase in the last 24 hours and a - price. ARMY UNIT COINS · New Product IG. CIA - Coin Reaper Red Volume discounts if available display in the cart. Price: Sale price$ Shipping calculated at checkout. SANS Challenge Coins: The Ultimate Recognition to Elite Cybersecurity Professionals The coins - more precisely, Round Metal Objects (RMO) - were initially. Shop for Challenge Coin Cia at irk-ajur.ru Save money. Live better. A challenge coin is a small coin or medallion, bearing an organization's insignia or emblem and carried by the organization's members. Challenge Coin · Benevolent Coin · Diversity in Paramedicine · Guillaume's Memorial Coin · PACE Saskatchewan · Vintage Benevolent Coin. $ Add to cart. CIA - Coin Reaper Red Volume discounts if available display in the cart. Price: Sale price$ Shipping calculated at checkout. CIA National Cyber Investigation Joint Task Force Challenge Coin · You might also be interested in · Join Our Mailing List · Customers Say · Follow Us. These custom CIA challenge coins are a perfect way to represent your department and can be customized to create a unique design that cannot be found anywhere. This coin may appear to be an Eisenhower silver dollar, but it is really a concealment device. It was used to hide messages or film so they could be sent. 1 3/4 inch Challenge Coin Acquired from a member of The Company. Buy America Military US Central Intelligence Agency Coin Gold CIA Challenge Coin Collectibles with Hard Capsule Business Gift at Aliexpress for. Challenge Coins; /; Additional Coins; /; CIA COIN.. CIA COIN. SKU: R. $ In stock. CIA COIN quantity. Add to cart. Add to wishlist. Category. Special Activities Division / SAD · Latebra Factum = Hiding Action · Veritatem Cognoscere = Know The Truth · Medallion / Challenge Coin.

1 2 3 4 5